January 15, 2025 - 15:18

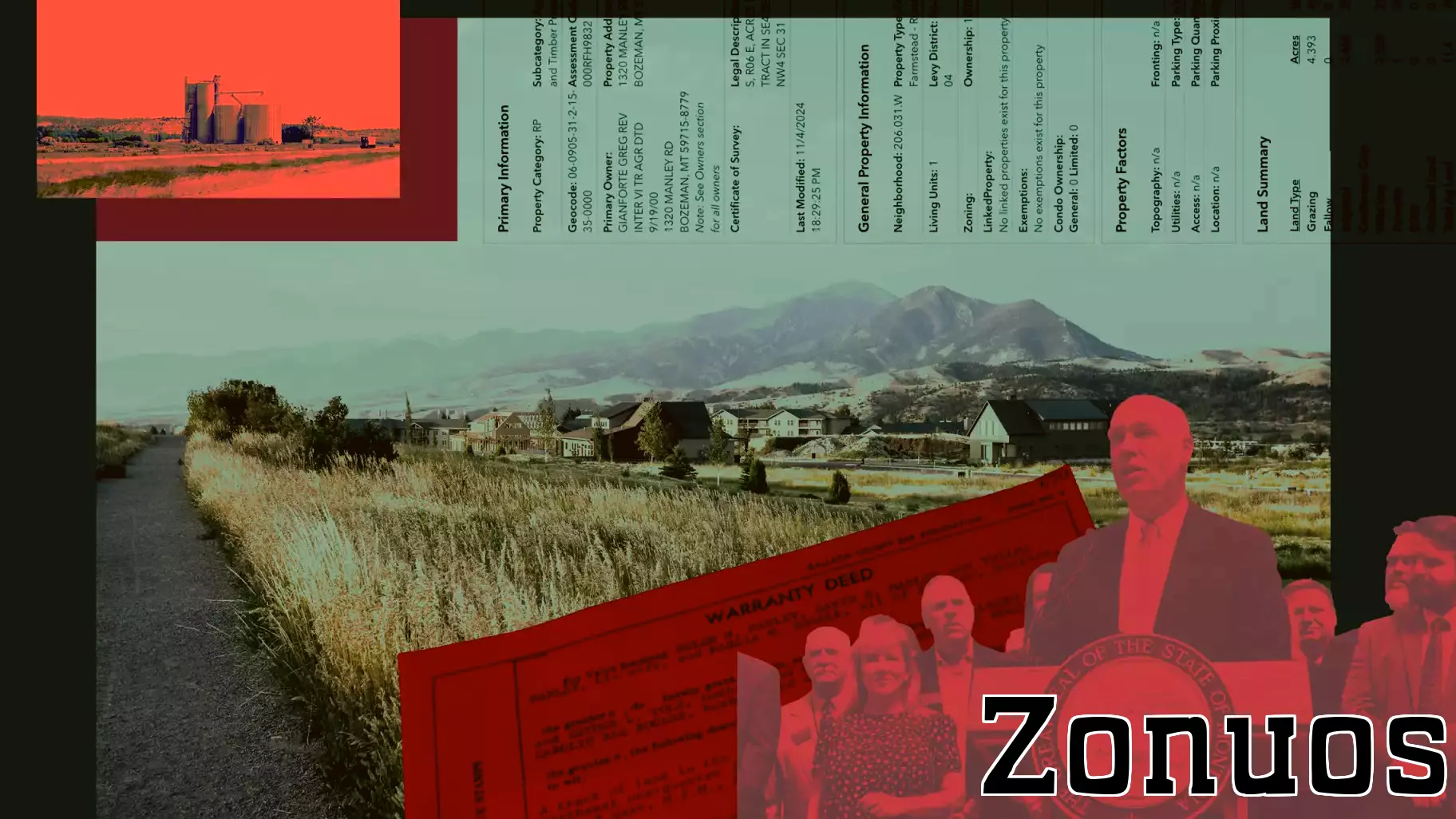

Recent investigations have uncovered intriguing insights into how luxury real estate in Montana is leveraging the state's agricultural tax code, originally designed to support farmers and ranchers. This system, intended to alleviate the financial burden on agricultural producers, has inadvertently become a beneficial tool for high-end property owners.

Luxury properties often utilize agricultural exemptions to significantly reduce their tax liabilities. By classifying portions of their land as agricultural, these property owners can take advantage of lower tax rates, which is a stark contrast to the higher taxes typically associated with luxury real estate. This practice raises questions about the equitable distribution of tax benefits and whether it undermines the intent of the agricultural tax code.

As affluent buyers increasingly flock to Montana for its scenic landscapes and outdoor lifestyle, the intersection of agriculture and luxury real estate continues to evolve. This trend not only impacts local economies but also highlights the complexities of tax legislation and its unintended consequences on different sectors. As discussions around tax reform gain momentum, the implications of such practices may prompt a reevaluation of existing laws to ensure they serve their intended purpose.