Important Legal Issues to Keep in Mind When Leasing Office Space

28 December 2024

Leasing office space is no small feat. Whether you’re a small startup, growing mid-sized business, or even an established enterprise, securing the right office space can feel like a major milestone. But let’s be real—while finding that perfect spot to house your team is exciting, the legal complexities of leasing can quickly bring you back down to earth.

Negotiating and signing a commercial lease isn’t just about picking a spot with modern finishes or good parking—it’s a legal commitment that can have long-lasting consequences. The stakes are high, and you don’t want to sign on the dotted line only to realize later that you're locked into unfavorable terms or facing hidden risks.

In this article, we’re diving into the essential legal issues you need to keep in mind when leasing office space. We’ll explore everything from lease terms to zoning restrictions, so you’re better equipped to negotiate and secure a space that works for your business—not against it.

1. Understand the Lease Agreement Like the Back of Your Hand

Here’s the deal: the lease agreement is the foundation of your office space rental. This isn’t the kind of document you can skim over before signing. It’s packed with legal jargon and clauses that can directly affect your bottom line.The key here is to read (and re-read) your lease carefully, ensuring you understand every single term. If the wording feels like it’s straight out of a law textbook, don’t hesitate to bring in a real estate attorney to explain everything in plain English. Trust me, paying for legal advice upfront is way better than dealing with surprises down the road.

Key Points to Look For:

- Length of the Lease (Term): Is it a short-term lease with flexibility, or are you locked in for 5+ years? Make sure the term aligns with your business goals.- Renewal Clauses: Does the lease allow you to renew? If so, on what terms?

- Rent Structure: Check for escalations (e.g., periodic rent increases) and ensure there are no hidden fees.

- Termination Terms: What happens if you need to leave early? Are there penalties or subleasing options?

2. Zoning Laws: Can You Legally Use the Space?

You wouldn’t rent a car dealership to open a bakery, right? The same logic applies to leasing office space. Before signing a lease, you need to ensure the property is legally zoned for your intended use.Zoning laws dictate how properties in specific areas can be used. Even if the space seems like a good fit, it’s your responsibility to verify that the zoning permits your type of business. A quick call to the local zoning office can save you a massive headache.

Pro Tip: If you need any specific permits to operate (like a business license or health permits), make sure the location complies before signing anything. You don’t want to set up shop only to face legal battles later.

3. Beware of Hidden Costs and Maintenance Responsibilities

Ever heard of the phrase, "The devil’s in the details"? That couldn’t be more true when it comes to leasing office space. Beyond the base rent, there might be additional costs you didn’t anticipate.Common Hidden Costs:

- Operating Expenses: Some leases make tenants responsible for expenses like property taxes, insurance, and common area maintenance (often called CAM charges).- Utility Payments: Are utilities included in the rent, or will you be billed separately?

- Repairs and Maintenance: Commercial landlords often pass repair obligations onto tenants. Check if you’re responsible for HVAC systems, plumbing, or other costly repairs.

Always ask for a breakdown of costs before signing the lease—otherwise, you might find yourself shelling out more than you bargained for.

4. Negotiate Favorable Lease Terms

Here’s a fun fact: just because a lease is presented to you doesn’t mean it’s set in stone. Lease agreements are highly negotiable! In fact, landlords often expect tenants to negotiate. So, put on your negotiation hat and fight for terms that benefit your business.Negotiation Tips:

- Request Rent-Free Periods: Many landlords are open to offering a “rent holiday” period at the start of the lease so you can settle in without financial pressure.- Cap Operating Expenses: If you’re responsible for shared costs, negotiate a cap to avoid unpredictable spikes.

- Include Subleasing Options: If you outgrow the space or need to downsize, having the ability to sublease can save you from breaking the lease.

Remember, while negotiation can feel intimidating, it’s all part of the game—and it can help you save money in the long run.

5. Understand Default Clauses and Penalties

What happens if something unexpected occurs and you can’t meet the terms of the lease? Maybe your business dips temporarily, or you need to relocate for expansion. Life happens, right?This is where default clauses come into play. Default clauses outline what happens if you breach the lease. Typically, landlords can terminate the agreement, seize your security deposit, and sue for damages.

What to Watch For:

- Grace Periods: Does the lease offer any grace period for missed rent?- Early Termination Options: Can you exit the lease early without a financial bloodbath?

- Force Majeure Clause: This protects you from liability if unforeseen events (like natural disasters) make it impossible to occupy the space.

6. Security Deposit and Return Policy

Let’s talk about the security deposit. Typically, landlords require a hefty upfront payment to cover potential damages or unpaid rent. While you may have no problem cutting the check, make sure the lease explicitly states under what conditions the deposit will be returned.Will it be refunded in full? Are deductions allowed? If so, for what reasons? Having these terms crystal clear can help avoid disputes when the lease ends.

Pro Tip: Always document the condition of the property when you move in. Take photos, videos, and detailed notes—your future self will thank you.

7. Insurance Requirements

Insurance might not be the most exciting topic, but it’s absolutely necessary. Most commercial leases will require you to carry certain types of insurance, such as general liability, business interruption insurance, or even property insurance.Make sure you’re clear on what level of coverage the lease demands and whether the landlord also carries insurance for the property. It’s all about protecting your business from unforeseen risks, like accidents or damages.

8. Environmental Laws and Compliance

Environmental compliance might not seem like an immediate concern, but trust me—it’s better to be safe than sorry. Some properties (especially older buildings) may contain hazardous materials like asbestos or lead paint. It’s important to make sure the landlord has addressed any environmental concerns before you move in.On top of that, check local laws to ensure your business operations won’t fall foul of environmental regulations. For example, if your business generates waste or uses toxic materials, you’ll need to account for that in your lease.

9. Legal Assistance Is Non-Negotiable

Leasing office space is a big decision with legal ramifications. You wouldn't perform surgery on yourself, so why would you try to DIY a legal contract? Having a real estate attorney on your side is essential to avoid getting blindsided by unfavorable terms.A qualified attorney can help you understand complex clauses, negotiate better terms, and ensure the lease complies with local laws. Think of them as your safety net—they’re there to catch the tricky parts you might miss.

10. Exit Strategy: Plan for the End from the Beginning

Every lease eventually comes to an end, so it’s wise to plan your exit strategy upfront. Does the lease require you to restore the space to its original condition? Are there specific notice periods for termination?Neglecting this part could leave you scrambling—and spending—when it’s time to pack up and move on.

Final Thoughts: Protect Your Business

Leasing office space might seem like a straightforward task on the surface, but the legal details lurking beneath can make or break your experience. By keeping these key legal issues in mind, you’ll be in a stronger position to secure a lease that meets your needs and protects your business interests.Now, go forth and conquer the commercial leasing world—but don’t forget to bring your lawyer along for the ride!

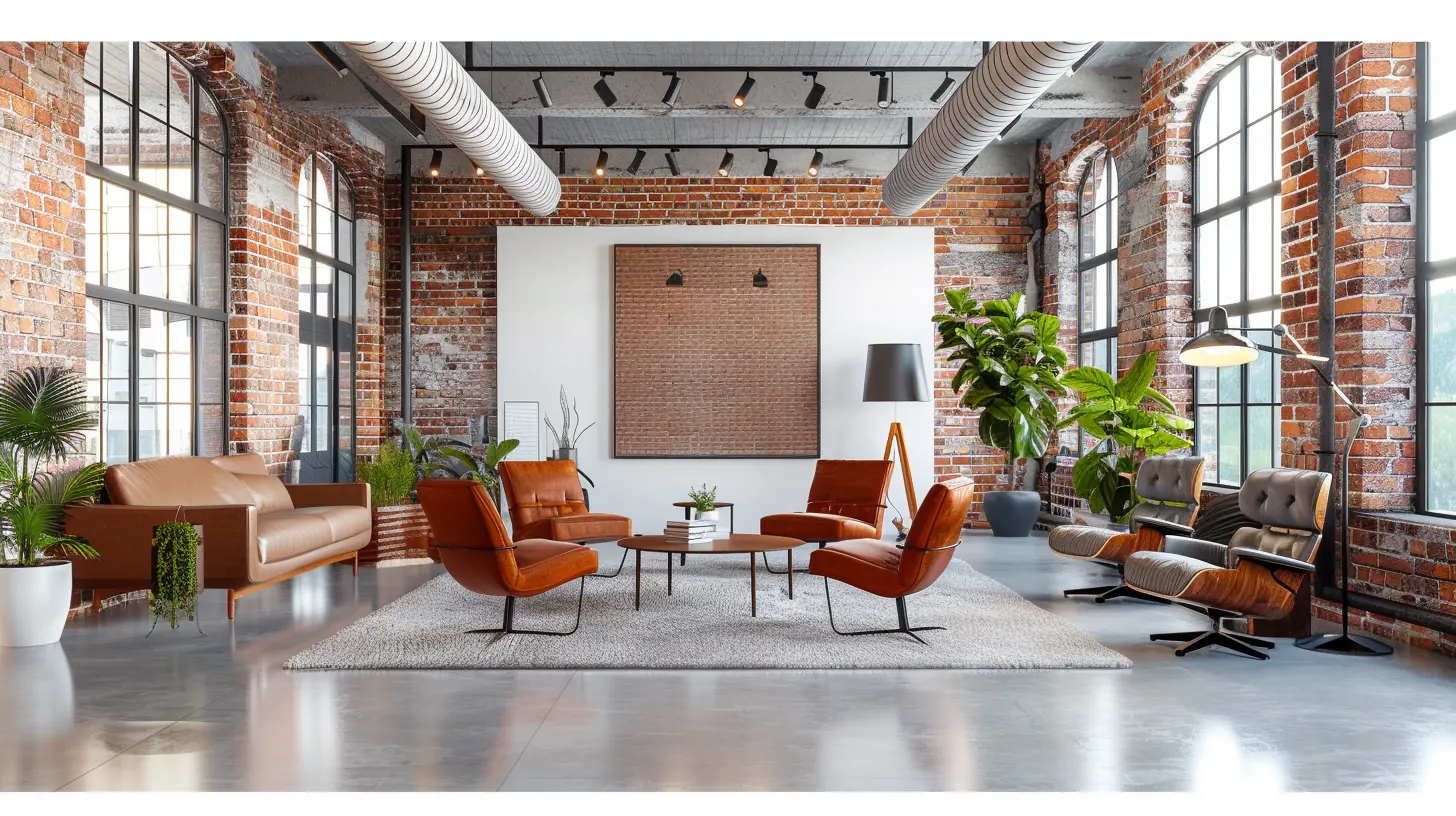

all images in this post were generated using AI tools

Category:

Commercial Real EstateAuthor:

Vincent Clayton

Discussion

rate this article

19 comments

Rune Scott

This article effectively highlights crucial legal considerations in leasing office space, such as lease terms, zoning regulations, and responsibilities for maintenance. Understanding these elements not only safeguards tenants against potential disputes but also ensures compliance with local laws. A thorough review prior to signing can prevent costly pitfalls down the road.

March 29, 2025 at 3:52 AM

Vincent Clayton

Thank you for your insightful comment! I'm glad you found the key legal considerations highlighted in the article helpful for navigating office leases.

Diana McAlister

Thoroughly review lease agreements to protect your rights and avoid costly disputes.

March 22, 2025 at 3:50 AM

Vincent Clayton

Absolutely! Careful review of lease agreements is essential for safeguarding your rights and preventing future disputes.

Zarev Phillips

Great insights! Understanding legal nuances is crucial for successful office leasing. Thank you!

February 9, 2025 at 8:38 PM

Vincent Clayton

Thank you for your kind words! I'm glad you found the insights helpful.

Runehart Hardy

Navigating lease agreements requires attention to critical legal aspects, such as lease terms, tenant rights, and potential liabilities. Understanding these factors can significantly mitigate risks and foster a successful landlord-tenant relationship.

February 2, 2025 at 3:25 AM

Vincent Clayton

Absolutely! Recognizing key legal aspects like lease terms and tenant rights is essential for minimizing risks and ensuring a smooth landlord-tenant dynamic.

Sasha Valentine

Great insights! Understanding the legal aspects of leasing office space is crucial. This article highlights essential considerations that every business should prioritize before signing a lease.

January 30, 2025 at 6:00 AM

Vincent Clayton

Thank you! I'm glad you found the article helpful. Understanding these legal aspects can truly make a difference in securing the right office space.

Kayla McIntire

Great insights, very helpful!

January 26, 2025 at 4:14 AM

Vincent Clayton

Thank you! I'm glad you found it helpful!

Nadia Edwards

Great insights on leasing! Understanding legal nuances is crucial for a successful office space agreement.

January 22, 2025 at 9:49 PM

Vincent Clayton

Thank you! I'm glad you found the insights helpful—understanding these legal nuances can truly make a difference in securing the right office space.

Tracie Green

Understanding the legal intricacies of leasing office space is crucial. Key issues like lease terms, tenant rights, and maintenance responsibilities can significantly impact your investment and operational success. Always consult a legal expert before signing.

January 18, 2025 at 11:53 AM

Vincent Clayton

Absolutely! Navigating lease agreements is essential for protecting your investment. Consulting a legal expert ensures you understand your rights and responsibilities.

Zayn Bellamy

Critical insights for tenants.

January 15, 2025 at 8:26 PM

Vincent Clayton

Thank you! I'm glad you found the insights valuable for tenants. Your awareness of these legal issues is crucial for a successful lease experience.

Kai Cooper

Navigating the legal landscape of office leasing is non-negotiable. Ignoring these issues could cost you dearly—be proactive, informed, and protect your investment fiercely!

January 11, 2025 at 9:44 PM

Vincent Clayton

Absolutely! Being proactive about legal considerations in office leasing is essential to safeguarding your investment and ensuring a smooth tenancy.

Wren Sharpe

Thank you for this insightful article! It's crucial to be aware of the legal aspects when leasing office space, as they can significantly impact our business operations. I appreciate the clear explanations and practical tips provided. It’s a great reminder to always read the fine print and consult a professional.

January 8, 2025 at 7:31 PM

Vincent Clayton

Thank you for your kind words! I'm glad you found the article helpful. Understanding legal aspects is indeed vital for successful leasing.

Zina Barrett

Great insights! Understanding legal aspects of leasing office space is crucial for a smooth and successful experience. Thanks for sharing!

January 4, 2025 at 4:13 AM

Vincent Clayton

Thank you! I’m glad you found the insights helpful. Understanding these legal aspects can truly make a difference in the leasing process!

Inez McGill

This article offers essential insights into the legal aspects of leasing office space. Understanding lease terms, tenant rights, and the importance of clear agreements can save businesses from future disputes. A solid legal foundation is crucial for a successful lease negotiation and a positive working environment. Well done!

January 1, 2025 at 1:54 PM

Vincent Clayton

Thank you for your thoughtful feedback! I'm glad you found the insights on lease terms and tenant rights valuable for fostering successful negotiations.

Emmeline Cooper

Great insights! Always review lease terms carefully.

December 30, 2024 at 1:07 PM

Vincent Clayton

Thank you! Reviewing lease terms is crucial to avoid potential pitfalls.

Carmen McIlroy

Great article! Leasing office space can be tricky, and it's easy to overlook the legal details amidst all the excitement. Your tips on key issues to consider are super helpful. A solid lease can save headaches down the road—thanks for breaking it down so clearly!

December 30, 2024 at 4:12 AM

Vincent Clayton

Thank you for your thoughtful comment! I'm glad you found the tips helpful—navigating lease agreements can indeed make a big difference.

Misty Cox

Thank you for this insightful article! It’s a crucial reminder of the legal aspects that often get overlooked in leasing. Your tips will definitely help many navigate their office space decisions better.

December 29, 2024 at 8:26 PM

Vincent Clayton

Thank you for your kind words! I’m glad you found the article helpful and that it sheds light on these important legal considerations.

Margaret Gates

In leasing realms where dreams align, Legal whispers guard the fine, A mindful tread on dotted line.

December 29, 2024 at 4:27 AM

Vincent Clayton

Thank you for capturing the essence of leasing! Legal considerations are indeed crucial for a smooth and successful office space agreement.

Lorelei McGillivray

Understanding lease terms protects your investment and fosters a positive relationship with your landlord. Choose wisely!

December 28, 2024 at 9:38 PM

Vincent Clayton

Thank you! Understanding lease terms is indeed crucial for safeguarding your investment and maintaining a good rapport with your landlord. Choosing wisely can lead to a more successful leasing experience.

Archer Rogers

Thank you for this insightful article! The legal considerations when leasing office space are often overlooked, yet crucial. Your tips on lease agreements and tenant rights are especially helpful. I’ll be sure to reference this as I navigate my own leasing process.

December 28, 2024 at 4:43 AM

Vincent Clayton

Thank you for your kind words! I’m glad you found the article helpful for your leasing process. Best of luck!

MORE POSTS

How to Maximize the Value of Your Home Sale

How Market Trends Impact Multifamily Property Valuations

Attracting High-Quality Tenants for Your Multifamily Property

Selling a Historic Home: Unique Challenges and Benefits

How to Find the Perfect Farmhouse for Your Peaceful Getaway

How to Photograph Homes with Unique Architectural Styles

Reverse Mortgages: A Guide to Fees and Costs

How Suburban Real Estate Is Adapting to Sustainable Building Trends

How Rising Interest Rates Affect Your Home Buying Power

How to Invest in Vacation Rental Properties for Optimal Returns

Timing Is Everything: When Is the Best Season to Start House Hunting?

How to Attract High-Quality Tenants to Your Rental Properties